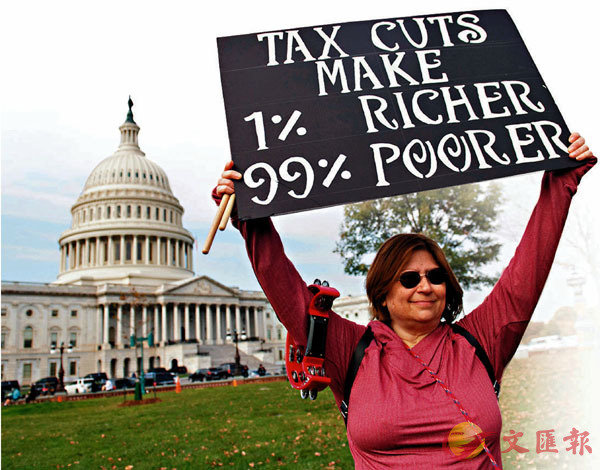

■分析指特朗普連任將會令富者愈富。 資料圖片

■分析指特朗普連任將會令富者愈富。 資料圖片美國今年多次爆發種族平權示威,加上新冠肺炎肆虐,令社會陷入迷失、困惑的一年,經濟受到嚴重打擊。經濟學家近日指出,雖然美國的新冠疫苗有望於明年中面世,但若國會依然未能通過大規模的刺激經濟方案,明年美國有50%機會陷入衰退,強調「在有效新冠疫苗面世前,我們需要金融疫苗」。

目前美國有近2,700萬人領取各種失業補助,較去年的140萬人呈幾何級增長。不少民眾擔憂飯碗不保,傾向減少消費,今年美國國內生產總值(GDP)料收縮5%。總統特朗普屢次阻撓抗疫紓困方案,令商戶和國民得不到補助,Economic Outlook Group首席全球經濟學家鮑爾稱,如果明年下半年甚至2022年初,都未有新冠疫苗及無全面刺激經濟方案,美國陷入衰退的機會極大。

鮑爾同時預測,若特朗普勝出大選,以及共和黨掌控參眾兩院,經濟增長將較拜登當選緩慢,明年美國GDP料增長僅2.2%,後年亦只有2.6%,較拜登當選預料的增長幅度3.4%和4.3%相差甚遠。鮑爾認為當踏入第二個任期,特朗普將不受連任包袱掣肘,預料會大幅減稅尤其薪俸稅,並聚焦減輕國債比率,但在不減少開支下,社會保障、醫療制度及補助等福利制度將需要改革。 ■綜合報道